Olymp Trade Islamic Accounts

Olymp Trade Islamic Avvounts Review

Olymp Trade Islamic Account Review – Our review on Olymp Trade Islamic Accounts provides an in-depth analysis of the trading platform’s features, specifically tailored for Muslim traders. This review focuses on the platform’s adherence to Islamic finance principles, such as the prohibition of interest (Riba) and uncertainty (Gharar). Olymp Trade Islamic Accounts are designed to facilitate Halal trading, ensuring that Muslim traders can participate in the global financial markets while still complying with their religious beliefs. The review covers various aspects, including account features, trading options, customer service, and the overall trading experience Olymp Trade provides to its Islamic account holders. Check out more Islamic Forex and CFD brokers.

Olymp Trade Islamic Accounts – What is Islamic trading account?

Olymp Trade, a leading online trading platform, has been making waves in the financial market since its inception in 2014. Its user-friendly interface, comprehensive educational resources, and wide range of trading options make it a preferred choice for traders worldwide. One of the unique features that sets Olymp Trade apart from its competitors is the provision of Islamic accounts designed to cater to the specific needs of Muslim traders. This article aims to provide an in-depth review of Olymp Trade Islamic accounts, shedding light on how they navigate the trading world in compliance with Islamic law.

Islamic finance is a financial system that operates according to the principles of Islamic law, known as Shariah law. Central to this system is the prohibition of Riba, or usury, which is interpreted as the prohibition of interest. In the context of trading, this means that traders cannot earn or pay interest on their trades. Olymp Trade, recognizing the importance of this principle, has introduced Islamic accounts that fully comply with Shariah law.

Olymp Trade Islamic accounts operate on the Halal principle, which is permissible in Arabic. These accounts are also known as swap-free accounts as they do not involve any swap or rollover interest on overnight positions, which is against the Islamic faith. This feature allows Muslim traders to participate in trading without compromising their religious beliefs.

Opening an Islamic account with Olymp Trade is straightforward. Traders must register for a standard account first. Once the standard account is set up, traders can request to convert it into an Islamic account. The request is typically processed within one business day, after which traders can start trading interest-free.

Despite being interest-free, Olymp Trade Islamic accounts offer the same features and benefits as standard accounts. Traders have access to a wide range of assets, including currency pairs, commodities, indices, and stocks. They can also leverage the platform’s advanced trading tools and charts to analyze market trends and make informed trading decisions. Moreover, Olymp Trade provides free educational resources, including webinars, tutorials, and e-books, to help traders enhance their trading skills and knowledge.

Advantages of Olymp Trade Islamic Accounts

One of the key advantages of Olymp Trade Islamic accounts is the absence of hidden fees or commissions. While other brokers may charge additional fees for swap-free accounts, Olymp Trade maintains a transparent fee structure with no additional charges for Islamic account holders. This transparency not only ensures compliance with Islamic law but also builds trust among traders.

In terms of customer support, Olymp Trade excels with a dedicated team available 24/7 to assist traders. Whether it’s a query about the platform, a technical issue, or a question about Islamic accounts, the customer support team is always ready to help.

What are the key features of Islamic Accounts?

The functionality of Olymp Trade Islamic Accounts is similar to that of standard accounts. Traders can access a wide range of financial instruments, including forex, commodities, indices, and stocks. The trading platform is user-friendly and intuitive, making it easy for both novice and experienced traders to navigate. It also offers a variety of analytical tools and indicators to help traders make informed decisions.

One of the standout features of Olymp Trade Islamic Accounts is the absence of hidden fees or commissions. While other trading platforms may charge hidden fees on Islamic accounts to compensate for the lack of interest, Olymp Trade maintains transparency by not imposing any additional charges. This commitment to fairness and transparency aligns with the Islamic principle of “gharar,” which prohibits deceit and uncertainty in financial transactions.

Another notable feature of Olymp Trade Islamic Accounts is the provision of free educational resources. Olymp Trade believes in empowering its traders with knowledge and skills to trade effectively. Therefore, it provides a wealth of educational materials, including webinars, tutorials, and e-books, to help traders understand the dynamics of the financial market. These resources are particularly beneficial for novice traders who are new to the world of online trading.

Demo Account – Olymp Trade

Olymp Trade also offers a demo account feature for its Islamic Accounts. This feature allows traders to practice their trading strategies with virtual funds before they start trading with real money. The demo account replicates the real trading environment, providing traders with a realistic trading experience without any financial risk. Check out more Fixed Time Trade and Binary Options Brokers providing Islamic trading accounts.

Olymp trade Islamic Account – User benefits

From a user’s perspective, the process of opening an Islamic account with Olymp Trade is straightforward and hassle-free. The platform does not require any additional documentation or complex procedures. Instead, users simply need to register for an account and then request the conversion of their account into an Islamic one. The customer service team at Olymp Trade is always ready to assist with this process, ensuring a smooth transition for users.

Once the account is set up, users can enjoy all the benefits that come with Olymp Trade’s platform. This includes access to a wide range of assets, including currency pairs, commodities, indices, and stocks. Users can also take advantage of Olymp Trade’s educational resources, which include webinars, tutorials, and trading strategies. These resources are particularly beneficial for novice traders, helping them to understand the intricacies of the financial market and to develop effective trading strategies.

One of the key advantages of Olymp Trade Islamic accounts is the absence of hidden fees or commissions. The platform operates on a transparent pricing model, with all costs clearly outlined. This transparency extends to the swap-free feature of the Islamic accounts, with no additional charges applied for holding positions overnight. This is a significant benefit for traders who prefer to keep their positions open for longer periods.

Moreover, Olymp Trade Islamic accounts offer the same competitive spreads as their standard counterparts. This means that users do not have to compromise on potential profits in order to adhere to their religious beliefs. The platform also provides the option of a free demo account, allowing users to practice their trading strategies without risking real money.

Olymp trade Platform Features

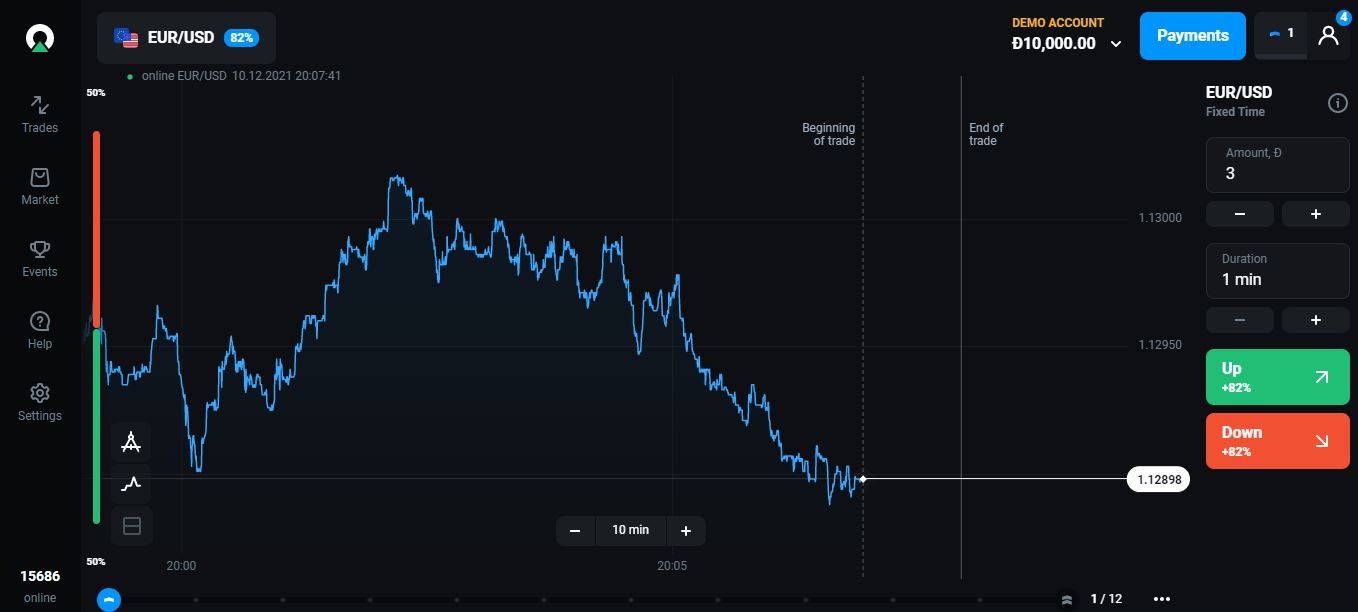

The Olymp Trade platform is renowned for its simplicity and ease of use, making it an ideal choice for both novice and experienced traders. The platform offers a wide range of financial instruments, including currency pairs, commodities, indices, and stocks. Traders can choose from over 70 different assets, providing ample opportunities for diversification.

One of the standout features of the Olymp Trade platform is its advanced charting tools. Traders have access to a variety of technical analysis tools, including trend lines, support and resistance levels, and various indicators such as moving averages and Bollinger Bands. These tools can be invaluable in helping traders make informed decisions about when to enter and exit trades.

In addition to its robust trading tools, Olymp Trade also offers a wealth of educational resources. These include interactive tutorials, webinars, and e-books, all designed to help traders improve their trading skills and knowledge. The platform also provides a free demo account, allowing traders to practice their strategies and get a feel for the platform before risking real money.

Customer service is another area where Olymp Trade excels. The platform offers 24/7 customer support, with a team of knowledgeable and friendly representatives available to assist traders with any issues or queries they may have. This level of support can be particularly reassuring for new traders who may need help navigating the platform or understanding certain features.

Security is a top priority at Olymp Trade. The platform uses advanced encryption technology to protect traders’ personal and financial information. It is also a member of the International Financial Commission, a neutral third party that provides traders with protection and dispute resolution services.

In terms of fees, Olymp Trade operates on a commission-based model. This means that traders are charged a percentage of their trade amount, rather than a fixed fee. This can be more cost-effective for traders who trade in large volumes.

Olymp Trade Fund Deposit and Withdrawal

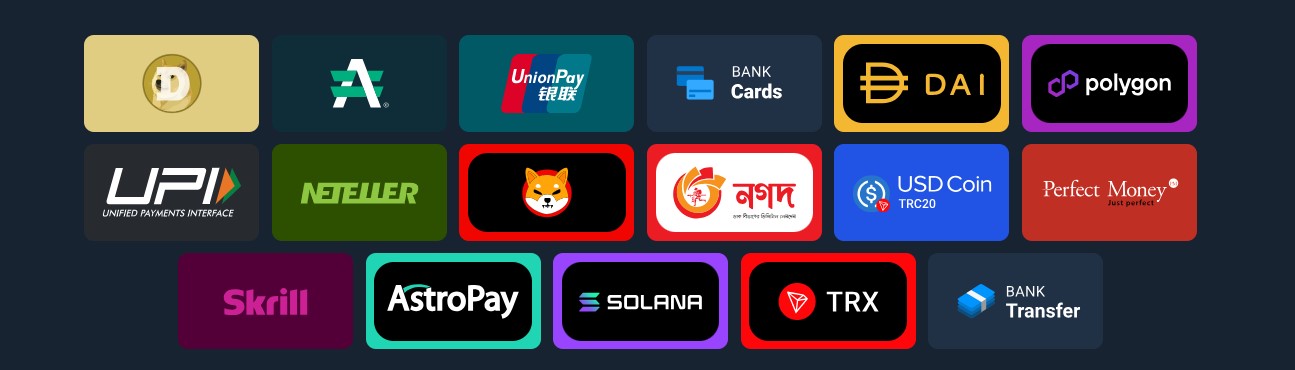

Olymp Trade offers a variety of funding methods to cater to the diverse needs of its global clientele. These methods are designed to be straightforward and efficient, ensuring that traders can fund their accounts and withdraw their earnings with ease. The platform accepts deposits through various channels, including credit and debit cards, e-wallets, and bank transfers. These options provide traders with the flexibility to choose a method that best suits their needs and preferences.

Depositing funds into an Olymp Trade account is a simple process. Traders are required to log into their accounts, navigate to the deposit section, select their preferred payment method, and enter the amount they wish to deposit. The platform does not charge any fees for deposits, and the funds are typically credited to the trader’s account instantly. This allows traders to start trading immediately, without any unnecessary delays.

Olymp Trade also offers a seamless withdrawal process. Traders can request withdrawals directly from their accounts, and the requests are usually processed within 24 hours. The platform prides itself on its transparency, and traders are provided with detailed information about the withdrawal process, including any applicable fees. It’s worth noting that Olymp Trade prioritizes the security of its clients’ funds. As such, all withdrawal requests are subjected to rigorous security checks to prevent fraudulent activities.

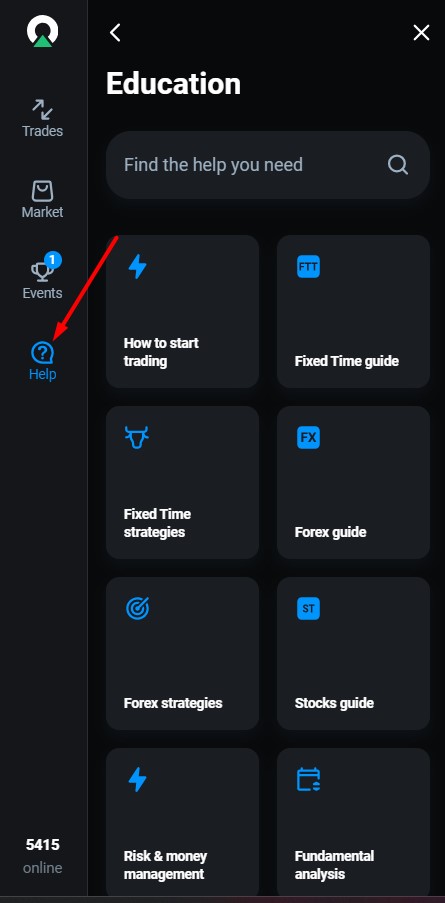

Olymp Trade Platform Education

Olymp Trade Platform Training is a comprehensive program designed to help traders, both beginners and professionals, understand and navigate the intricate aspects of the Olymp Trade platform. The training encompasses various strategies, techniques and tools used in trading including market analysis, risk management, and decision-making processes. It offers a blend of theoretical knowledge and practical training to help traders make informed trading decisions, maximizing their profits while minimizing potential losses. The training program is typically conducted online, allowing participants to learn at their own pace and convenience. It also includes interactive sessions where users can ask questions and get clarifications on any aspects they find challenging.

Olymp Trade Online Trading Education

Olymp Trade provides comprehensive educational resources to help traders make informed decisions. These include webinars, tutorials, and articles on various trading strategies and market analysis techniques. Such resources are particularly beneficial for novice traders, helping them to gain a solid understanding of the trading process.

Olymp Trade Education is a comprehensive learning program provided by the Olymp Trade platform, which aims to equip traders with the necessary knowledge and skills to navigate the world of online trading. This educational program includes a variety of resources such as video tutorials, webinars, blog articles, interactive courses, and expert strategies that cover many topics, from basic to advanced trading techniques. Through Olymp Trade education, traders can gain an in-depth understanding of financial markets, learn how to analyze market trends and develop effective trading strategies. It is a valuable resource for both beginners and experienced traders to enhance their trading proficiency and potentially increase their chances of success in the trading world.

Olymp Trade Mobile App

The Olymp Trade Mobile Trading App is an innovative platform that allows users to trade financial instruments from anywhere in the world directly from their smartphones. This app offers a range of assets to trade, including currency pairs, commodities, indices, and stocks. It provides real-time market updates and allows users to manage their trades, analyze market trends, and make informed trading decisions on the go. The app is user-friendly and designed with advanced features to cater to both beginner and experienced traders. It also offers educational resources and customer support to enhance the trading experience. The Olymp Trade Mobile Trading App is a reliable and efficient tool for anyone interested in online trading.

Is Olymp Trade Halal?

Yes, it is halal to trade with Olymo Trade in an Islamic trading account. Olymp Trade is a widely recognized online trading platform that offers various types of trading options. For those adhering to Islamic law, it is permitted or “halal” to trade with Olymp Trade, provided it is done through an Islamic trading account. This specific type of account is structured in accordance with the principles of Islamic law, which strictly prohibits usury or “riba” (the practice of lending money at high-interest rates). Consequently, an Islamic trading account with Olymp Trade does not involve any swaps or interest charges, ensuring that Muslim traders can participate in online trading without violating their religious beliefs.

Olymp Trade Islamic Review – Conclusion

Olymp Trade Islamic accounts offer a unique and valuable service for Muslim traders. By adhering to the principles of Islamic law, these accounts allow traders to engage in online trading in a manner that aligns with their religious beliefs. The absence of overnight fees, the diversity of trading instruments, and the provision of educational resources further enhance the appeal of these accounts. Coupled with excellent customer support, Olymp Trade Islamic accounts provide a comprehensive and user-friendly trading experience. Therefore, they are a commendable choice for Muslim traders seeking a Sharia-compliant trading platform.

These accounts do not incur swap or rollover charges for holding positions overnight, adhering to the Islamic prohibition of earning interest. However, like any trading platform, potential users should thoroughly research and consider the risks before investing.